February 4, 2026

Categories:

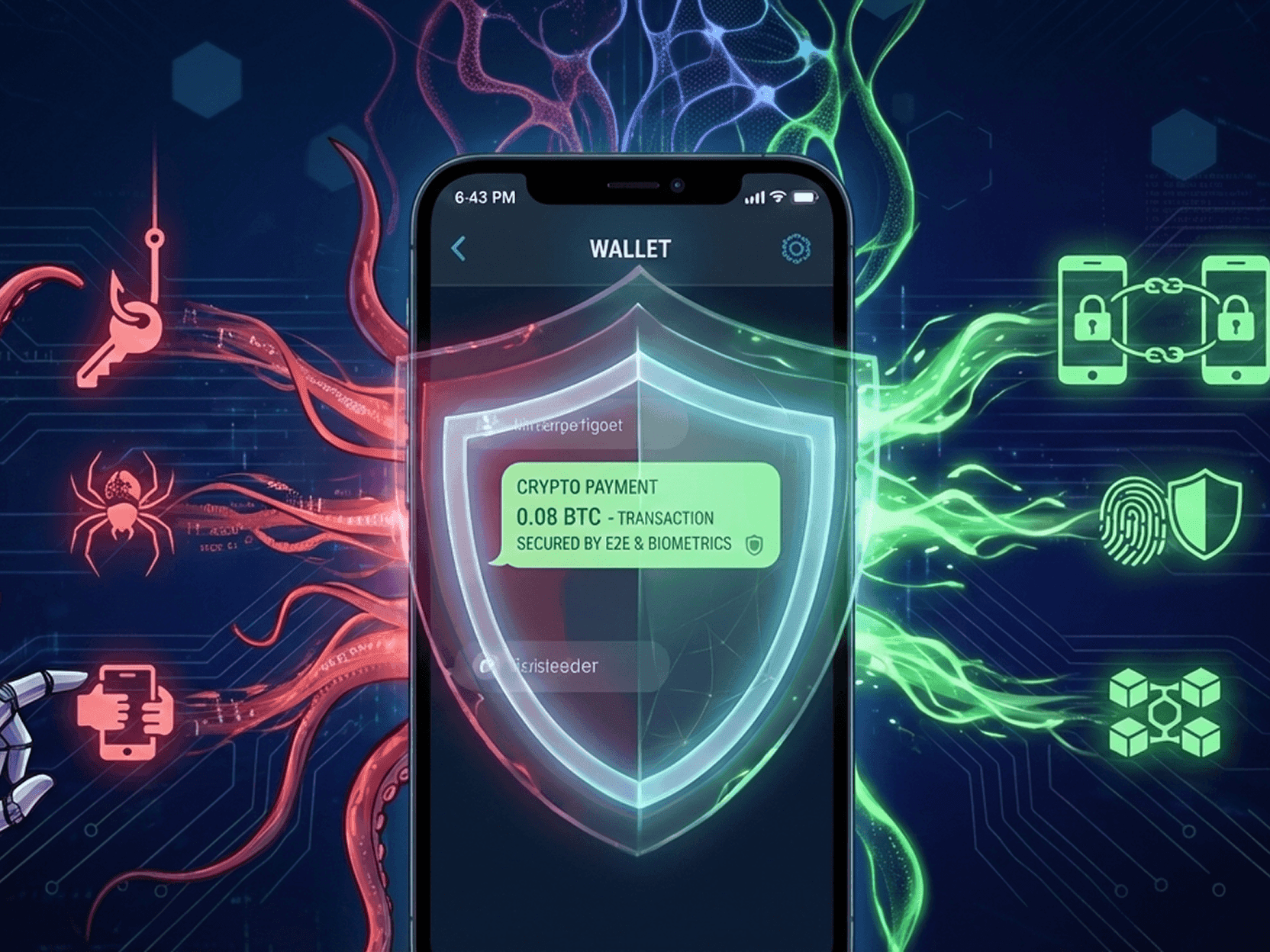

How Do Messenger Crypto Wallets Protect Against Hacking?

Article written with ChatGPT AI

This article explains how crypto wallets in chat apps protect users from hacking, where risks usually appear, and what security practices actually matter.

*Resume created with artificial intelligence

Crypto wallets integrated into messenger apps are designed to make payments feel as easy as sending a message. But convenience alone doesn’t equal security. When crypto is handled inside a chat app, the attack surface changes — and so do the risks.

To understand how these wallets protect users, it helps to first look at how things can go wrong.

Common Ways Crypto Payments in Messengers Get Compromised

1.

1. Account takeover through identity linkage

If a messenger wallet is tied to a phone number, email, or centralized account, attackers may target that identity instead of the wallet itself. SIM-swap attacks, phishing emails, or reused passwords can give access to the entire account — including funds.2.

2. Server-side wallet control

Some chat apps manage private keys or transaction signing on their servers. This creates a single point of failure: server breaches, insider access, and forced account recovery.

If the app can access keys, attackers potentially can too.3.

3. Fake contacts and impersonation

In chat-based payments, users often trust names, avatars, or conversation history. Attackers exploit this by impersonating contacts and requesting payments inside ongoing chats — especially in group conversations.4.

4. Malware on the device

If a wallet relies only on app-level security, malware or screen-recording tools on the device can capture sensitive actions like transaction confirmations or recovery phrases.

Security Measures That Actually Matter

Not all messenger wallets are built the same. The most secure ones follow a few core principles.

1.

1. Self-custody by default

The safest wallets never store private keys on servers. Keys are generated and stored locally on the user’s device. This means no backend access to funds, account recovery that bypasses the user, or mass compromise if servers are breached.2.

2. End-to-end encrypted transactions

Just like private messages, payment requests, and confirmations should be encrypted device-to-device. This prevents interception, manipulation, or metadata leakage during in-chat payments.3.

3. Minimal identity exposure

Wallets that don’t require phone numbers or emails reduce the risk of identity-based attacks. Anonymous or pseudonymous accounts limit how attackers can target users.4.

4. Explicit transaction confirmation

Clear, user-controlled confirmation steps (amount, recipient, network) reduce the risk of accidental or manipulated payments — especially in fast chat flows.5.

5. No persistent transaction logs on servers

Some apps keep detailed payment metadata even if messages are encrypted. Best-practice wallets avoid storing transaction histories or balances centrally.

Key Takeaway

Messenger crypto wallets aren’t hacked because crypto is weak — they’re compromised when identity, keys, and metadata are overexposed.

The most secure chat-based wallets follow a simple rule: what the app doesn’t have, attackers can’t steal. And in private conversations with financial value, that principle matters more than speed or convenience.

If you share financial details or send crypto in chats, use a messenger that doesn’t store them. EXTRA SAFE minimizes data exposure by design, keeping conversations and crypto ownership truly private.